Term life insurance : What is it & how does it work?

Term life insurance policy is among one of the absolute most prominent kinds of life insurance policy offered since it is simple, inexpensive, as well as lasts provided that you require — for many people, that is in between 10 as well as 40 years.

Costs could be paid out regular month-to-month or even yearly, as well as for fairly reduced prices, your recipients obtain a tax-free round figure of cash after you pass away.

What is term life insurance?

Phrase life insurance policy assurances monetary security for your household over a particular duration — the phrase — prior to expiring. If you pass away prior to the phrase conclusions, your recipient gets a life insurance policy fatality profit that could be utilized towards deal with funeral service sets you back, expenses, or even every other costs.

Due to reduced prices as well as simpleness, a phrase plan is actually the very best type of life insurance policy for many people.

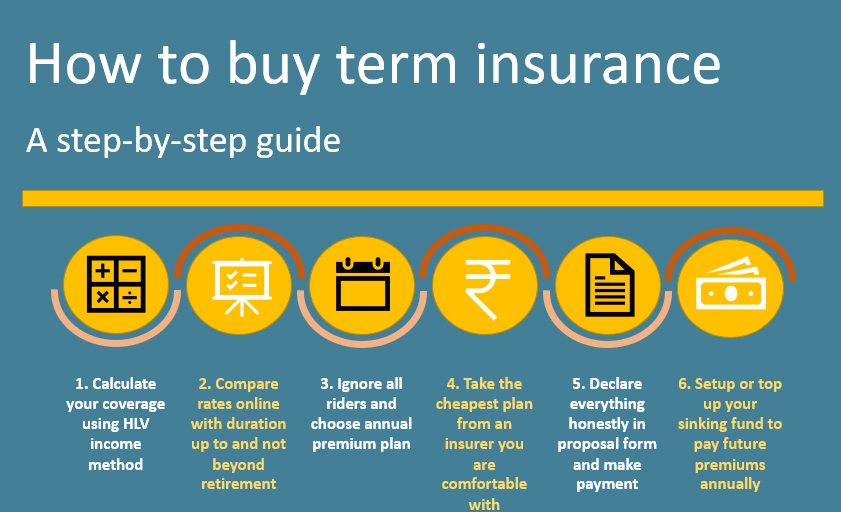

data by policygenius

Exactly just how performs term life insurance policy function?

Unlike long-term life insurance policy, which lasts for the remainder of your lifestyle as well as includes a money worth, phrase lifestyle is actually simple towards handle as well as affordable. Phrases typically final 10 towards 40 years, after which you can easily restore your plan, transform it towards long-term protection, or even allow the plan expire.

Costs are actually based upon a number of elements — consisting of your grow older, sex, health and wellness, as well as plan option — as well as could be paid out on a regular monthly or even yearly manner.

You can easily select your phrase size as well as protection quantity therefore you do not spend for much a lot extra monetary security compared to you require.Unless you have actually a distinct monetary circumstance or even will certainly be actually offering long-lasting financial backing, phrase lifestyle protection creates much a lot extra feeling for the typical individual.

Kinds of Term life insurance policy

While conventional phrase lifestyle is actually one of the absolute most simple kind of life insurance policy as well as the straight choice for many people, certainly there certainly are actually some variants of phrase lifestyle that might suit your requirements.

For instance, more youthful as well as much healthier candidates that wish to avoid the clinical exam can easily request a no-med phrase plan to obtain dealt with quicker. Dealing with enhancing your health and wellness? A annual sustainable phrase plan might deserve thinking about.

No-medical-exam

A phrase lifestyle plan without any clinical exam demand creates obtaining a plan quick as well as contactless. Rather than a clinical assessment, the insurance provider creates a request choice based upon your current health and wellness documents as well as a telephone speak with.

You can easily obtain competitively valued protection in as low as 24 hr. Individuals along with couple of health and wellness issues are actually most likely towards certify.

Yearly sustainable

An yearly sustainable plan (likewise referred to as annual sustainable) has actually a phrase that lasts simply one year. You have to restore every year towards proceed your protection, along with price modifications at each revival.

Costs typically begin less than for a plan along with a much longer phrase, however ultimately end up being a lot greater the much a lot longer you restore.

This is actually a helpful choice if you just require protection for a short duration or even if you are creating health and wellness as well as way of life modifications that might make you reduced prices on a plan along with a much longer phrase in a couple of years.

For instance, if you are quitting cigarette smoking cigarettes or even dealing with reducing your cholesterol, you may take advantage of possessing a yearly sustainable plan while you develop a performance history of therapy as well as enhancement.

Reducing phrase

In a reducing phrase plan, your costs remain the exact very same however your fatality profit decreases the much a lot longer you have actually the plan (typically every year).

Reducing phrase plans generally do not have actually clinical demands for authorization, however that implies they're typically much a lot extra costly compared to a conventional phrase plan. A conventional plan will certainly likewise offer much a lot extra protection for the cost.

Various other kinds of life insurance policy

Team life insurance policy

This is actually a kind of yearly sustainable insurance coverage that is provided with a company you come from — for many people, it is their company. Costs are actually dealt with mainly or even completely due to the company as well as certainly there certainly are actually no health and wellness limitations to obtain dealt with. Team plans are actually restricted because they typically do not deal sufficient protection as well as you seldom maintain all of them if you leave behind a task,

Home loan security insurance coverage (MPI)

MPI is actually a kind of reducing phrase plan where the protection is actually connected for your home loan. The phrase lasts the size of your lending as well as the fatality profit reduces as you settle your home loan. The recipient of MPI is actually your loan provider, certainly not your household.

Gain of costs (ROP)

Gain of costs is actually in some cases offered as a standalone plan as well as more frequently viewed as a biker you can easily contribute to your protection for an additional expense. ROP protection refunds your previous costs resettlements if you outlast your phrase protection. Nevertheless, the plans are actually expensive.

Enhancing term

An enhancing phrase plan has actually a fatality profit that increases at collection periods throughout your protection. For instance, your profit may enhance through 5% each year. Costs can easily vary, depending upon your insurance provider. Prices are actually greater for this kind of plan.

Term life insurance vs. whole life insurance

Very most insurance coverage consumers will certainly eventually choose in between purchasing phrase or even entire life insurance policy. Our team typically suggest phrase over entire life insurance policy since it is much a lot extra inexpensive as well as couple of individuals require the additional functions consisted of in entire lifestyle.

Expense of costs

Entire lifestyle sets you back 5 towards 15 opportunities greater than phrase lifestyle for comparable protection quantities. That is since entire lifestyle lasts much a lot longer as well as has actually an extra cost financial savings include referred to as the money worth.

If cost is actually a concern as well as you do not believe you will sustain somebody economically for the remainder of your lifestyle, phrase lifestyle is actually a much better choice. Here is a fast expense contrast for 35-year-olds purchasing a $500,000 plan:

Accessibility of protection

Phrase as well as entire life insurance policy are actually both very most typical kinds of protection, therefore you will have the ability to purchase either coming from very most lifestyle insurance provider.

Some service companies might have actually much a lot extra kinds of phrase plans towards deal you — for instance, you may have the ability to select a no-exam phrase plan or even one along with a clinical exam.

It is a lot more difficult towards discover a service provider that will certainly deal you entire life insurance policy without a clinical exam at the exact very same degree of protection you will obtain if you took an examination.

Financial assets worth

One significant factor individuals decide to purchase an entire lifestyle plan is actually the money worth cost financial savings include. This jobs such as a financial investment profile that is moneyed through component of your costs monthly. The money worth expands at a price collection through your service company.

If you've currently maxed out your various other financial assets choices or even you're an individual along with a higher total assets, you might think about an entire lifestyle plan for its own financial assets worth. Nevertheless, rate of passion development is actually reduced compared with a 401(k) or even IRA, as well as you will pay out much a lot extra towards have actually the long-lasting protection.

That ought to think about term life insurance policy?

A phrase lifestyle plan is actually finest for most of individuals since it is easy as well as affordable. If you ultimately strategy towards settle your financial obligations, sustain your retired life along with your cost financial savings, as well as reach a factor where nobody depends upon your earnings, after that a phrase plan is actually a suitable monetary security choice.

Advantages of term life insurance policy

The primary advantages of purchasing a phrase lifestyle plan are actually:

- Inexpensive: Compared with intermittent kind of life insurance policy, prices are actually considerably less expensive. This creates it simple towards maintain your plan energetic while conserving as well as spending.

- Versatility: Adjustable phrase sizes as well as protection quantities imply you can easily purchase monetary security particular for your requirements.

- No termination charge: Unlike various other plans, there is never ever a charge or even charge for terminating phrase lifestyle protection. If you do not require it any longer, you can easily just point your agreement.

- Simpleness: Plans along with a money worth have actually charges, rate of interest, as well as various other functions towards handle. Phrase lifestyle has actually none of those, creating it user-friendly for its own primary work: sustaining your household in a worst-case situation.

Is actually phrase life insurance policy well really truly worth it?

Indeed, if anybody depends on you for financial backing or even you have actually discussed financial obligations, it is well really truly worth purchasing a phrase lifestyle plan. The inexpensive prices, contrasted for monetary security you can easily purchase for your household, create it a fantastic worth for your cash. As well as if your plan does not suit your requirements any longer, it is simple towards upgrade or even point your protection later on.

Just the amount of term life insurance policy perform you require?

When choosing just the amount of phrase life insurance policy towards purchase, go for 10 towards 30 opportunities your earnings as well as consider:

- Exceptional financial obligations

- Dependents

- Potential costs

- End-of-life sets you back

Your plan ought to final provided that your lengthiest financial obligation as well as ought to deal with every other monetary responsibilities.

What happens when the term ends?

Among the advantages of phrase life insurance policy is actually that the plan ends by the end of the phrase, therefore you can easily reassess your requirements. You may choose you require much less protection or even no protection whatsoever. When your plan is actually finishing, you can easily:

- Transform your phrase plan right in to a long-term plan.

- Maintain your present plan at a greater costs.

- Purchase a brand-new plan.

- Allow the plan expire.

If you are still conserving for retired life, paying out off a home loan, or even lifting kids, it might make good sense towards maintain your present plan at a greater expense or even look for a brand-new one. When you achieve your monetary objectives as well as/or even no more have actually dependents, you most likely do not require a plan any longer.

Perform you obtain your cash back by the end of a term lifestyle plan?

You do not obtain a reimbursement on your costs if you outlast your plan (unless you purchased gain of costs protection). As kept in mind over, our team do not suggest gain of costs plans due to their higher expense.

The just exemption is actually if you terminate your plan during a invoicing pattern or even throughout the preliminary totally complimentary appearance duration. The totally complimentary appearance duration is actually typically the very initial thirty days of your plan.

If you terminate throughout this time around your very initial costs is actually reimbursed. If you terminate during a invoicing pattern, you will be actually reimbursed a prorated quantity coming from your very most current costs resettlement.

Obtaining phrase protection should not be actually difficult. Our certified representatives will help you contrast estimates as well as response concerns therefore you can easily obtain the life insurance policy you require at an inexpensive cost.